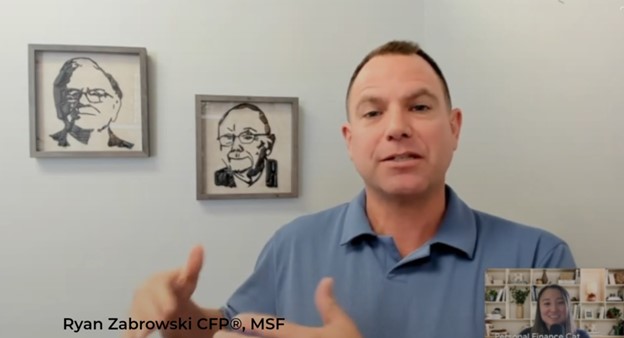

Ryan Zabrowski highlights a critical distinction in investment strategy: instead of solely asking, How can I profit from robotics?, great investors consider, What industries will be disadvantaged by this trend? He underscores the importance of understanding how technological advancements, like robotics, can create “value traps”—businesses that appear undervalued but face fundamental challenges due to an increasingly hostile operating environment. With disruptive technology siphoning market share, these companies find themselves battling the “winds of capitalism.” Zabrowski’s insight emphasizes that successful investing isn’t just about chasing opportunities but also avoiding pitfalls in industries that are losing ground to innovation.

**Be sure to first consult with a qualified financial advisor and/or tax professional before implementing any strategy discussed herein.