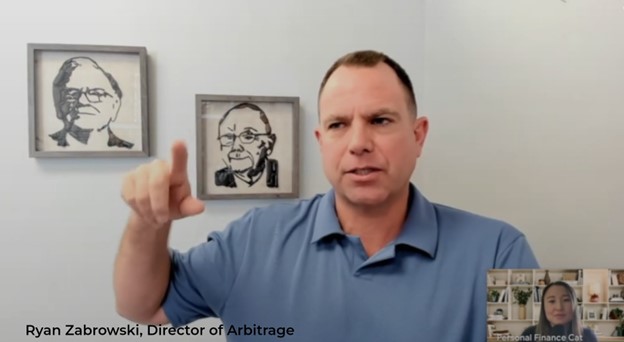

In a recent episode of Personal Finance Cat, investment advisor Ryan Zabrowski delved into the nuances of tax loss harvesting, a strategy that investors use to minimize their tax liabilities. Zabrowski explained that the key to successful tax loss harvesting lies in finding a highly correlated security to replace the one you sell at a loss. By doing so, investors can maintain their market exposure while adhering to IRS rules.

**Be sure to first consult with a qualified financial advisor and/or tax professional before implementing any strategy discussed herein.

Krilogy Financial, LLC (Krilogy) is a Securities and Exchange Commission (“SEC”) Registered Investment Advisor. Registration with the SEC should not be considered an express or implied approval of Krilogy by the SEC. Krilogy does not provide tax and legal advice. All expressions of opinion are subject to change. This information is distributed for educational purposes only, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. Investments involve risk and unless otherwise stated, are not guaranteed. Investors should understand the risks involved of owning investments, including interest rate risk, credit risk and market risk. Be sure to first consult with a qualified financial advisor and/or tax professional before implementing any strategies discussed herein.